What is a certificate of incorporation?

When starting a company, one of the essential steps is obtaining a certificate of incorporation. So, what is a certificate of incorporation? This key legal document verifies that your company is officially registered as a separate legal entity. It includes critical details like the company's name, registration number, and incorporation date. In this blog, Aniday is going to delve into what a certificate of incorporation is, why it is important, and how you can obtain one through various methods.

What is a certificate of incorporation?

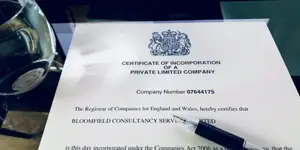

A certificate of incorporation (COI) is a crucial legal document that officially establishes a company or corporation. It includes essential details such as the date of incorporation and the company registration number, making it a fundamental part of a corporation’s constitutional documents.

If the ACRA is the main document to prove a company's status, the COI is the document confirming the company's registration in Singapore. It proves that the entity has been legally formed and is often issued by state governments or, in some cases, by non-governmental entities.

A certificate of incorporation is a legal document that confirms a company’s registration and existence.

How to get a certificate of incorporation?

Starting a business in Singapore involves several key steps, with obtaining a certificate of incorporation being one of the most crucial. This document officially confirms that your company is registered as a legal entity. Here’s a comprehensive guide to help you through the process:

- Preparation: Consult advisory services for guidance and familiarize yourself with regulatory requirements.

- Provide company details: Submit accurate information about your company’s Directors and Shareholders, ensuring at least one local Director is a Singapore Citizen.

- Complete the application: Prepare and submit all necessary documents and forms required for incorporation.

- Payment: Pay the registration fee using a Credit/Debit Card, PayPal, or Bank Transfer, as per your preference.

- Receive the certificate: The certificate of incorporation will be sent to you by mail (DHL/TNT/FedEx) within 2 to 5 working days.

- Post-incorporation steps: Finalize additional services such as opening a bank account or applying for trademarks if needed.

6 steps to secure your certificate of incorporation in Singapore

You may be interested in: Best recruitment agency in singapore

What information does a certificate of incorporation include?

Understanding the certificate of incorporation’s components will help ensure that your company is properly registered and compliant with legal requirements. Whether you’re launching a new business or updating your company’s records, knowing what’s included in this document is vital for smooth and effective corporate management. Key components of a certificate of incorporation include:

- Corporation's legal name: Ensure the name is unique and distinguishable, typically including suffixes like "Inc.", "Corp.", or "Ltd."

- Corporation's registered office: The official address for legal documents and records.

- Business code: An identifier for the type of business or industry.

- The purpose of the company: Describes the business activities; some jurisdictions accept broad purposes, while others require specifics.

- Type of corporation: Specifies the corporate structure, such as C-corp or S-corp.

- Incorporator's name and address: The individual or entity responsible for filing the certificate.

- Registered agent's name and address: The designated recipient of legal documents.

- Board of Directors names and addresses: Contact details of the initial board members.

- Share capital: Details of the share structure, including the number and types of shares issued.

- Filing date: The date when the certificate of incorporation is filed.

Additional notes:

- Share capital: Usually includes a standard structure of 200 shares without a par value.

- Organization of the company: Addresses of the registered agent, directors, and potential auditors.

- Filer (Incorporator’s name and address): The person filing will receive a receipt confirming the date of filing and details.

Understanding the certificate of incorporation ensures legal compliance and proper registration

You could find this useful:

Maternity leave policy in india

How to set up a pt company in indonesia

Who needs to submit a certificate of incorporation?

A certificate of incorporation is a fundamental document required for various aspects of establishing and operating a corporation. Those who need to submit a certificate of incorporation include:

- Entrepreneurs starting a new business: Individuals or groups looking to create a new corporation must file a certificate of incorporation to formally register the company as a separate legal entity.

- Business owners transitioning to a corporation: Existing businesses that are changing their structure from a sole proprietorship or partnership to a corporation need to file this certificate to formalize their new legal status.

- Companies creating subsidiaries or branches: When a parent company establishes a new subsidiary or branch that operates as a separate legal entity, a certificate of incorporation for the new entity is required.

- Individuals or groups seeking to open a corporate bank account: To open a bank account in the corporation’s name, the certificate of incorporation must be filed. This document is necessary for banks to verify the legal status and structure of the business.

- Businesses applying for licenses and permits: To apply for various business licenses and permits, companies need to submit a certificate of incorporation to comply with local, state, and federal regulations.

- Companies hiring employees: Before hiring employees, the certificate of incorporation must be filed to establish the company’s legal identity, which is essential for complying with employment laws and managing payroll.

- Entities filing taxes: The certificate of incorporation is required for tax filing purposes, as it establishes the business’s legal identity needed for tax reporting and compliance.

How much does it cost to file?

ACRA in Singapore is the sole agency responsible for handling the preparation, signing, issuance, distribution, and regulation of incorporation certificates. After successfully incorporating a company, an e-notification is sent to all company officers and the principal registration applicant. Subsequently, you can obtain the COI through Singapore ACRA's BizFile portal for a fee of S$50 for an electronic version. Additionally, consider other costs such as state franchise taxes, business licenses, and attorney fees.

Filing fees for a certificate of incorporation vary by state

How to obtain a replacement for a lost certificate of incorporation?

If you require a new COI due to loss, updates, or international business incorporation needs, you can follow these four simple steps:

- Step 1: Log in to BizFile+ on ACRA's platform, offering a variety of services globally.

- Step 2: Choose "Buy Details."

- Step 3: Pay the $50 processing fee.

- Step 4: Within 15 minutes, you will receive an email containing a download link for your legally signed Certificate of Incorporation.

What is the certificate of incorporation used for?

The certificate of incorporation is used to legally verify a company's formation and registration. It is essential for opening business bank accounts, applying for loans, obtaining business licenses, and proving the company’s legal existence for various official purposes. It serves multiple important purposes, such as:

- Opening business bank accounts: Financial institutions require this document to validate the legal status of the company before allowing the opening of corporate bank accounts.

- Applying for loans or funding: Lenders use the certificate to confirm that the company is legally registered and entitled to request financing or business loans.

- Obtaining business licenses and permits: Many regulatory authorities require a certificate of incorporation as part of the application process for business licenses and permits.

- Establishing credibility: It serves as proof of the company's legal standing, reassuring clients, investors, suppliers, and partners that the business is legitimate.

- Operating internationally: In many cases, companies need a notarized version of the certificate when expanding operations overseas or setting up branches in other countries.

- Filing taxes: Authorities may request the certificate to confirm the legal identity of the company for tax purposes.

Do I need a new certificate of incorporation if my company’s name changes?

No, you do not need a new certificate of incorporation if your company’s name changes. Instead, you will receive a certificate of incorporation on Change of Name, which reflects the updated company name.

A name change requires a certificate of incorporation on the change of name.

In conclusion, understanding what is a certificate of incorporation is essential for anyone looking to establish a company. This vital document serves as proof of your company’s legal existence and is required for various business activities, from opening a bank account to securing loans.

Things you may like:

Aniday's HR Services

Headhunting Service

Find and recruit quality candidates in just 1 week! Supported by 40,000 experienced headhunters in IT, Finance, Marketing… capable of recruiting in any region.

Headhunting Service ➔Employer of Record (EOR) Service

On behalf of your business, we recruit employees and handle payroll without the need to establish a company in markets such as Vietnam, Singapore, Malaysia, India, Indonesia…

Employer of Record (EOR) Service ➔