What's the High Threshold for Exciting Investment Banking

Every year, as graduation and job hunting season approaches, international students majoring in finance exude confidence and a sense of grandeur, akin to the Palace of Versailles. The reason behind this isn't just the alluring prospect of enviable salaries!

Let's consider two well-known examples: J.P. Morgan and Goldman Sachs. In the case of J.P. Morgan, the first-year analysts receive a base salary of US$102k, along with a US$87k bonus, resulting in an annual total income of US$189k.

At Goldman Sachs, first-year analysts receive a base salary of US$110k, combined with a US$89k bonus, for an annual total income of US$199k.

It's not limited to just these two companies; the starting salaries across the entire industry significantly outpace those of graduates from other fields.

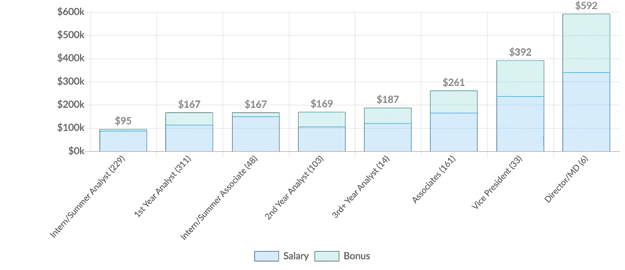

Compensation Comparison

Recently, Wall Street Oasis (WSO), known as a "financial barometer," released its latest 2023 employment salary data. In the world of investment banking, even a first-year Analyst is guaranteed a base salary of US$88k.

But hold on, there's more to consider! Even with these enticing perks, high salaries naturally correlate with high entry requirements. To step into this coveted financial world, you need to find the right approach.

Prepare Early, Start Early

It's essential to understand that when it comes to job hunting, waiting until after graduation to begin preparations means you've already missed a significant opportunity. In fact, many well-known investment banks identify students in their first or second year and offer them internships or part-time positions.

Top: Goldman Sachs' junior Exploratory Program, Next: Morgan Stanley recruits sophomores

Hence, staying abreast of information on the official websites of major companies in advance can give you a head start.

Develop a Multitude of Skills

Despite majoring in finance, some students may find it challenging to apply their knowledge in real-world scenarios. For instance, when asked to analyze the upcoming quarter's business situation using financial reports, some may feel at a loss due to a lack of practical experience. To enter the financial sector and establish a solid footing, you need certain essential skills, including:

Valuation modeling: Evaluating a company's worth through Excel modeling and forecasting its business and financial performance.

Financial analysis: Accurately assessing a company's situation through data and making sound analyses and judgments regarding its objectives.

Programming skills: In the realm of investment banking, proficiency in programming is a prerequisite. Not knowing how to program is akin to being illiterate, as it's essential for acquiring and analyzing financial data. Most major investment banks' official websites now specify strong data analysis skills as a requirement. Programming isn't merely an advantage; it's a necessity.

Seek Guidance from Seasoned Professionals

While the entry requirements for investment banking are undoubtedly high, having experienced mentors willing to assist you can greatly expedite your journey. These mentors have spent years in the industry and possess in-depth knowledge of its evolving dynamics, different role options, and the fundamental skills required to enter the field. This wealth of knowledge and information can propel you ahead of others, lower the entry barrier, and facilitate your seamless entry into the investment banking realm.

Aniday's HR Services

Headhunting Service

Find and recruit quality candidates in just 1 week! Supported by 40,000 experienced headhunters in IT, Finance, Marketing… capable of recruiting in any region.

Headhunting Service ➔Employer of Record (EOR) Service

On behalf of your business, we recruit employees and handle payroll without the need to establish a company in markets such as Vietnam, Singapore, Malaysia, India, Indonesia…

Employer of Record (EOR) Service ➔