What is Nonemployee Compensation?

In an ever-evolving work landscape of the 21st century, where traditional job roles are giving way to freelancers, contractors, and gig workers, there's a burning question: What is Nonemployee Compensation? Join Aniday on a journey to unravel this intriguing concept and witness how it's reshaping the future of work and business.

What is Nonemployee Compensation?

Nonemployee compensation, or nonemployee income, involves payments to non-employees for their services. These individuals or entities aren't classified as conventional employees and are often reported through Form 1099-NEC for tax purposes. This includes payments to freelancers, independent contractors, and vendors, among others.

Nonemployee compensation can also be paid to employees who are working on a temporary or freelance basis.

Why is Nonemployee Compensation Important?

Understanding nonemployee compensation is crucial for businesses, individuals, and tax authorities.

-

For businesses, it ensures compliance with tax regulations and labor laws while offering flexibility in workforce management.

-

For individuals providing services, it is essential to grasp their tax responsibilities.

-

Additionally, tax authorities, like the IRS, use nonemployee compensation data to monitor tax compliance and ensure accurate reporting.

Types of Nonemployee Compensation

Nonemployee compensation comes in various forms, with some of the most prevalent including:

-

Wages and Salaries: The most common form of nonemployee compensation, paid to contractors and consultants for their services.

-

Commissions: Compensation tied to sales or work performance.

-

Bonuses: Additional compensation, often awarded based on performance or other criteria.

-

Reimbursements: Payments to cover expenses incurred by contractors and consultants during their work.

-

Insurance: Providing coverage for contractors and consultants in case of injury or illness.

Who can receive nonemployee compensation?

Nonemployee compensation is a versatile concept that encompasses a broad spectrum of individuals and entities. The recipients of nonemployee compensation often include:

-

Independent Contractors: Self-employed individuals or entities providing specific services under contracts.

-

Freelancers: Independent professionals hired for project-based work.

-

Consultants: Experts offering guidance on business operations.

-

Vendors and Suppliers: Providers of goods and services to other businesses.

-

Gig Workers: On-demand, short-term task performers.

-

Honoraria Recipients: Professionals compensated for presentations and appearances.

Differences Between Nonemployee Compensation and Employee Compensation

Significant distinctions exist between nonemployee and employee compensation.

-

Taxation: Nonemployees are responsible for their own taxes, including income and self-employment taxes. In contrast, employers withhold and remit taxes for regular employees.

-

Benefits: Regular employees often receive benefits such as health insurance, retirement plans, and paid time off, while nonemployees typically do not.

-

Duration: Nonemployee compensation is often project-based or temporary, while employee compensation is usually ongoing, with fixed salaries or hourly wages.

Regulations and Laws Related to Nonemployee Compensation

Numerous regulations and laws govern nonemployee compensation, ensuring the rights of both businesses and individuals are safeguarded.

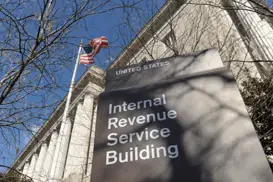

1. IRS (Internal Revenue Service) and its Treatment of Nonemployee Compensation

The IRS plays a central role in regulating nonemployee compensation. It requires businesses to report payments to nonemployees using Form 1099-NEC. Nonemployees must report this income on their tax returns. Understanding the IRS regulations is essential to ensure compliance.

2. Tax Responsibilities and Reporting Requirements Related to Nonemployee Compensation

Businesses must report nonemployee compensation accurately to the IRS, including payment amounts and recipient details, to avoid penalties. Nonemployees are accountable for self-employment taxes and tax law compliance.

3. Other Applicable Legal Regulations

Beyond IRS rules, additional legal obligations may vary by industry and location, encompassing state labor laws, contracts, and sector-specific standards.

Advantages and Disadvantages of Nonemployee Compensation

Nonemployee compensation comes with both pros and cons.

1. Benefits of Utilizing Nonemployee Compensation in Business Models

Nonemployee compensation offers businesses several advantages, such as:

-

Cost savings: Nonemployees are often cost-effective because they do not receive benefits or require office space.

-

Flexibility: Businesses can hire nonemployees for specific projects or on a temporary basis.

-

Access to specialized skills: Nonemployees often bring unique expertise to the table.

2. Drawbacks and Potential Risks Associated with Nonemployee Compensation

However, there are also potential disadvantages and risks:

-

Less control: Businesses may have limited control over nonemployees' work processes.

-

Legal compliance: Ensuring compliance with tax and labor laws can be challenging.

-

Reputation risks: Misclassifying workers as nonemployees can harm a company's reputation.

How to Manage and Comply with Nonemployee Compensation

Businesses that use nonemployee compensation should have a system in place to manage and comply with the associated regulations and laws. This system should include the following:

1. Financial Management Methods for Dealing with Nonemployee Compensation

To effectively manage nonemployee compensation, businesses should:

-

Keep accurate records: Maintain detailed records of payments to nonemployees.

-

Establish clear contracts: Clearly outline the terms of the work and payment in contracts.

-

Monitor tax obligations: Understand tax requirements for both businesses and nonemployees.

2. Strategies for Compliance with Regulations and Laws

Businesses should prioritize compliance by:

-

Staying informed: Keep up-to-date with IRS and relevant industry regulations.

-

Seeking legal counsel: Consult with legal experts to ensure proper classification and reporting.

-

Conducting regular audits: Periodically review nonemployee compensation processes for compliance.

Case Studies of Nonemployee Compensation in Specific Industries

We will explore real-world examples of nonemployee compensation in industries such as technology, healthcare, and entertainment to illustrate how nonemployee compensation is used in practice.

1. Tech Industry: Agile Workforce

-

Utilizing freelance developers and designers for project-specific expertise.

-

Enhancing agility and meeting tight deadlines.

2. Healthcare: Specialized Support

-

Contracting nonemployee specialists for top-quality patient care.

-

Efficiently meeting unique needs while complying with industry regulations.

3. Entertainment and the Arts: Fostering Creativity

-

Engaging actors and creatives on a project basis.

-

Nurturing diverse talents and artistic endeavors within the industry.

4. E-commerce and Vendor Collaboration

-

Partnering with vendors in e-commerce operations.

-

Streamlining relationships to maintain a seamless supply chain and cost optimization.

Conclusion

By the article's end, Aniday hopes readers will have a clear grasp of "what is nonemployee compensation?", from its various forms to legal obligations, benefits, and challenges. This knowledge empowers businesses to tackle nonemployee compensation with confidence and success.

Aniday's HR Services

Headhunting Service

Find and recruit quality candidates in just 1 week! Supported by 40,000 experienced headhunters in IT, Finance, Marketing… capable of recruiting in any region.

Headhunting Service ➔Employer of Record (EOR) Service

On behalf of your business, we recruit employees and handle payroll without the need to establish a company in markets such as Vietnam, Singapore, Malaysia, India, Indonesia…

Employer of Record (EOR) Service ➔