#3 factors influencing e-commerce platforms in Vietnam

I am Lam Tran, the founder and current CEO of WisePass. This company was established in October 2014 to enable brands to build more effective relationships with consumers.

This article discusses the future of e-commerce in Vietnam and what might change based on my personal perspective. The article examines three critical factors that could potentially transform the e-commerce landscape.

Competitive Landscape

The e-commerce market in Vietnam is dominated by three major companies: Shopee, Lazada, and Tiki. According to Similar Web's findings, Shopee currently holds the lead in terms of key indicators. With high monthly traffic, Shopee appears to be the clear winner at the present moment. However, when looking at other promising companies, they are formidable competitors that have the potential to change the game.

Firstly, Amazon has entered Vietnam. They have completed the legal establishment of their company to officially participate in the market and compete with these giants. Currently, their main focus is on attracting sellers and increasing market transactions globally. It is understandable because the Vietnamese market may still be small for Amazon. I believe that in the future, the market will grow sufficiently within the next 60 months.

I believe that Grab seems to be the next formidable competitor because Grab was originally established as an e-commerce platform. The strategy to become a super app is very fitting because they have the capability to incorporate e-commerce, strong capital, and most importantly, e-commerce is a significant revenue growth opportunity in the Southeast Asian region, including Vietnam.

Currently, Grab is busy with its SPAC listing in the US, and it will take at least a year to complete this process. The question is when they will implement e-commerce throughout the entire Southeast Asian region. My prediction is that they will do so within the next 36 months.

Business Profitability

If you are seeking profit value for e-commerce operations, I advise you to look beyond the perspective of being a founder or investor. This is a long-term game of revenue growth and a way to determine value.

E-commerce platforms consume money, and that's why you may see what is happening with Tiki, while Lazada is now owned by Alibaba and Shopee is part of the SEA Group. Here is the profit and loss (P&L) in the early days:

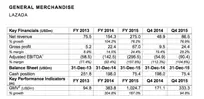

This is a snapshot of Lazada's financial situation according to Techcrunch's report, showing you what happens when operating an e-commerce platform. The key point is the Cash position, while post-tax revenue increases. To continue moving forward, you need strong capital.

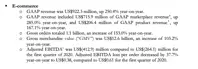

To be profitable, a company needs a significant number of monthly orders to cover all fixed costs and ensure the company has enough traffic to avoid paying for order fulfillment. However, this may not happen when looking at Shopee's financial situation in Q1, 2021 as follows.

Shopee South East Asia recorded a negative EBITDA of $412 million in Q1 2021, but the overall situation of the group shows optimism. Click here for more information.

Operating an e-commerce platform is a process that requires burning a significant amount of money over a long period of time, and serious financial investment is necessary.

Financial support

Returning to the Vietnamese market, we have Lazada, Shopee, and Tiki. Let's start with Shopee.

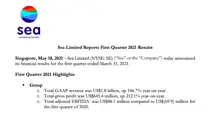

They currently disclose quarterly financial information as listed on the New York Stock Exchange. Below are some details you can see from the group in Q1 2021.

You can click here to view the full report. The company has the potential for further development when looking at the current profitability. Overall, the SEA Group shows positive signs and has $5 billion in cash on the balance sheet.

The SEA Group has plans to develop the e-commerce platform, and as a result, Shopee is growing stronger.

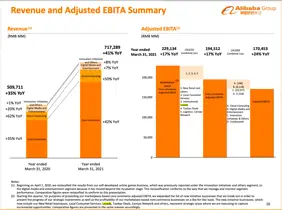

Regarding Lazada, the e-commerce platform owned by Alibaba Group generates billions of dollars annually before EBITDA. You can click here to see the additional report.

Alibaba Group will be able to inject billions of dollars as needed and will expand in the Southeast Asian region as it is the largest population group they see near the Chinese market. Another significant e-commerce market in Asia is India, but I don't think Alibaba has any plans to enter this market in the near future.

As for Tiki, it's a bit different because Tiki still relies on venture capital and continues to raise funds regularly to increase revenue. Hopefully, the company can maintain a lower cost structure to avoid burning money like Shopee and Lazada. If the company can continue to successfully raise capital in the coming years, it will be stable.

According to the latest news, Tiki will raise up to $200 million and may proceed with stock trading on the stock exchange.

E-commerce is not simply comprised of these three factors. However, if competition increases and players continue to lose more money as they scale up, and if they are not adequately funded, there is a real possibility of significant changes in the coming years. However, I don't think this will happen soon.

Aniday's HR Services

Headhunting Service

Find and recruit quality candidates in just 1 week! Supported by 40,000 experienced headhunters in IT, Finance, Marketing… capable of recruiting in any region.

Headhunting Service ➔Employer of Record (EOR) Service

On behalf of your business, we recruit employees and handle payroll without the need to establish a company in markets such as Vietnam, Singapore, Malaysia, India, Indonesia…

Employer of Record (EOR) Service ➔